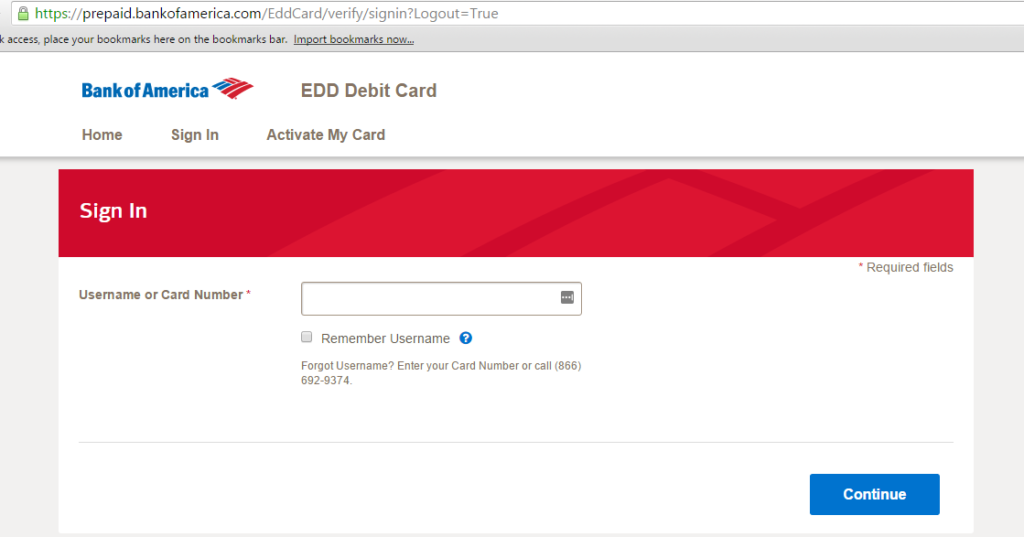

- Bank of america secure bank login verification#

- Bank of america secure bank login software#

- Bank of america secure bank login code#

- Bank of america secure bank login password#

Bank of america secure bank login software#

Bank of america secure bank login password#

Coach you through steps to complete an action, like changing your password.Ask you to click links or open attachments to confirm your identity.

Bank of america secure bank login verification#

This may be an account verification code, bank account number, PIN or social security number. Watch for: An unexpected phone call, email, text, direct message or pop-up with a request for personal information. By the time the check is discovered to be fraudulent, the scammer has the money you sent and you may owe money to the bank for that check. The bank may make funds available, but that does not mean the check has cleared the paying bank or may not be returned unpaid as fraudulent at a later date. Bank of America will never ask you to transfer money to anyone, including yourself, and we will never ask you to transfer money because we detected fraud on your account.īy law, banks must make deposited funds available quickly. Always verify who you’re sending money to before you send it. Be wary when someone says you have to pay in unusual ways. Remember: Many of these forms of payments are like cash and nearly impossible to trace or get back.

They can use fake email addresses and Caller ID information – don’t trust them. Remember: Scammers use convincing stories. Insist you download apps or click links to “fix” issues or confirm information.

Bank of america secure bank login code#

Try to confirm your identity with a verification code they send you – even though they called you.Ask for a favor, personal details, remote access to your devices or money.Contact you out of the blue and claim there’s an issue that needs immediate attention.Watch for: A phone call, email, text, direct message or pop-up with a request for personal information or money. Review all five scenarios for important red flags that could signal a scam. The most common scams will target you through fake emails, text messages, voice calls, letters or even someone who unexpectedly shows up at your front door.

0 kommentar(er)

0 kommentar(er)